- HOME

- Les essentiels de la cybersécurité

- Les essentiels de la cybersécurité

- Lutte contre la Criminalité Financière

- Gestion opérationnelle d’une crise cyber

- Le Règlement DORA

- La Directive NIS2

- Les Fondamentaux de la Norme ISO 27001

- Loi 05-20 – Cybersécurité et Résilience Numérique au Maroc

- La Directive REC (Résilience des Entités Critiques)

- Formation IAS DDA et RGPD

- Formation DCI IOBSP et RGPD

- COURSES

- CONSULTING

- RESOURCES

- ABOUT

- FAQ

Governance, Risk & Compliance Services

It is important that financial entities begin to assess the impact of this regulatory change on their risk management framework and prepare to meet the requirements set out by regulation.

When companies embark on the road to compliance, they should be able to read and interpret legislation, apply it to their own ICT and Risk management strategy, identify gaps and implement the program.

Strengthen your compliance program with our team of compliance professionals.

Compliance teams need continuous support and knowledge sharing to stay on top of global regulatory initiatives. Our team will help you navigating the evolving regulatory landscape while considering the complexity of your firm’s unique compliance requirements.

Thus, we are here to help you transform your business to reshape it for the future, while sustaining operations, reducing risk, generating long-term value and maintaining trust.

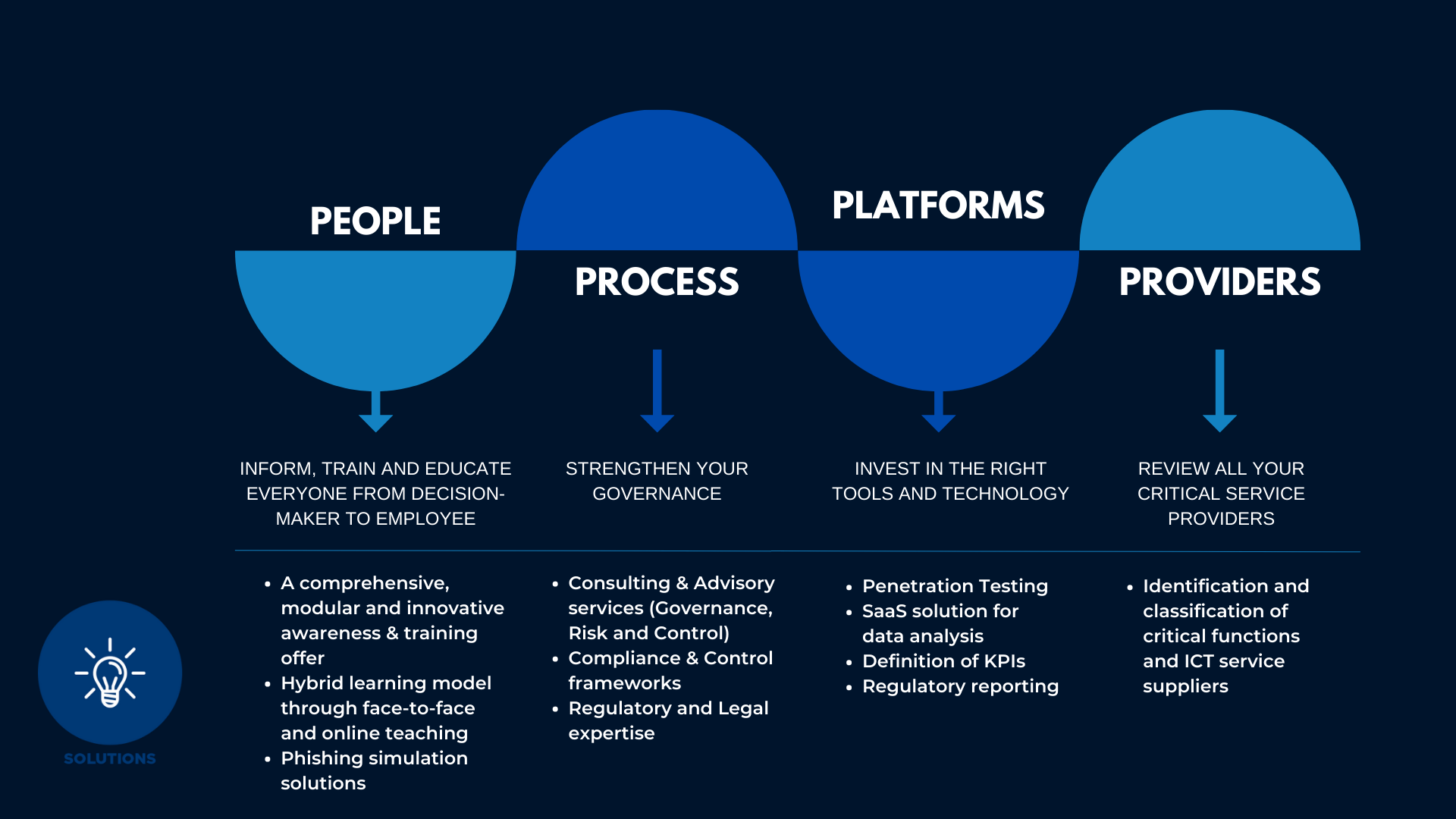

Our Capabilities

Our management consulting services focus on our clients’ most critical issues and opportunities: strategy, organization, operations, technology, transformation, digital, and compliance across all geographies.

We bring deep and functional expertise, but also a holistic perspective: we capture value across boundaries and between the silos of your organization.

Organizational performance

We know that performance always improves when leadership is at its best. Leadership plays a great role in setting teams’ direction, the creation of strategies and effectively implementing them to achieve goals, efficient communication, alignment of goals across the organization, development of the employees, accountability, and best usage of resources.

Advisory & Consulting

We deliver informative advisory and consulting solutions to each of our clients, tailored to meet your unique needs and challenges. Our team is equipped with years of experience and the dexterity to meet your evolving needs. We consider every variable and explore every possibility until we find the right one.

Regulatory Compliance

With the regulatory environment constantly evolving, the compliance target is always moving. Because regulatory compliance is such a big deal, your business needs to take a comprehensive, intentional approach to creating an effective regulatory compliance program. Thorough training should accompany the program’s implementation to ensure employees understand the importance of regulatory compliance and how it impacts their day-to-day jobs.

Data & Analytics

Data and Analytics (D&A) refers to the ways data is managed to support all uses of data, and the analysis of data to drive improved decisions, business processes and outcomes, such as discovering new business risks, challenges and opportunities. Data analytics relies on a variety of software tools ranging from spreadsheets, data visualization, and reporting tools.